Lists

23 Books

Interesting Investment Books

Sort by:

Recent Desc

Investment Books I have read. Only includes books that I personally think are particularly useful or interesting, as a lot of them have variations on themes.

Liked by

More lists by I Remember

War Films

List includes: Apocalypse Now, Full Metal Jacket, Patton

February 2021

0

@yozick72

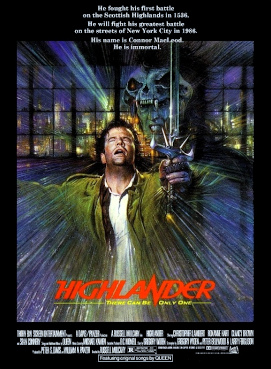

Sword and Sorcery films

List includes: Highlander, Conan the Barbarian, The 13th Warrior

February 2021

1

@yozick72

British TV and Films

When we were young! Tv and British films from the late 60's to the 90s with a few classics thrown in.

February 2021

1

@yozick72

Classic Fiction Writers

List includes: Homer, Charles Dickens, Anton Chekhov

February 2021

0

@yozick72

American TV Shows

List includes: The Wire, Generation Kill, Band of Brothers

February 2021

0

@yozick72

Classic Comic Books

List includes: Asterix in Britain, Prisoners of the Sun, Tintin in the Land of the Soviets

February 2021

0

@yozick72

20th Century Weird & Horror Fiction

List includes: Edgar Allan Poe, H.P. Lovecraft, Ambrose Bierce

February 2021

1

@yozick72

Film Noir

List includes: The Third Man, North by Northwest, The Night of the Hunter

February 2021

0

@yozick72

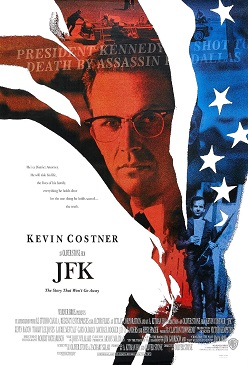

Conspiracy Political Thriller Films

List includes: JFK, The Conversation, The Manchurian Candidate

February 2021

0

@yozick72