Lists

12 Books

The Fascinating World of Economics

Sort by:

Recent Desc

Economics is ultimately about human behaviour. Understanding it can help deconstruct many common myths and fallacies.

Liked by

More lists by Andrei Oghina

Some test list

List includes: The Silence of the Lambs

February 2023

0

@andrei

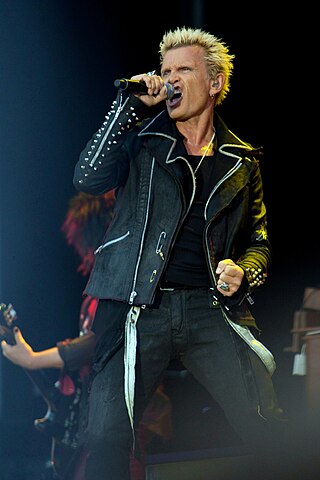

Music for long night drives

Nice downtempo electronic music, perfect for chilling or (preferably rainy) long night drives.

June 2022

8

@andrei

80's and 90's nostalgia

Some oldies but goldies from the 80's and 90's, dance and more.

December 2021

6

@andrei

Movies with biggest plot twist

Some movies with totally unexpected plot twists that are scary or leave you wondering.

November 2020

8

@andrei

Strange TV shows

Some TV shows with a strange or dark edge that I enjoyed.

October 2020

2

@andrei

Movies with best soundtracks

Movies with great soundtracks that make you want to dance, send shivers down your spine, or just make you nostalgic.

July 2020

7

@andrei