Lists

2 Movies

business

Sort by:

Recent Desc

More lists by Timer Tak

survivor

List includes: Cast Away, Buried, 127 Hours

April 2022

0

@volcikas

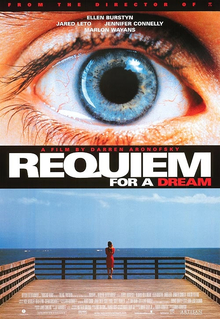

to check

List includes: 500 Days of Summer, Mars Attacks!, Requiem for a Dream

March 2022

0

@volcikas

mystery

List includes: Prometheus

March 2022

0

@volcikas

military, war, soldiers

List includes: Saving Private Ryan, The Hurt Locker, Hacksaw Ridge

February 2022

0

@volcikas

down depresuha

List includes: The Jacket

October 2021

0

@volcikas

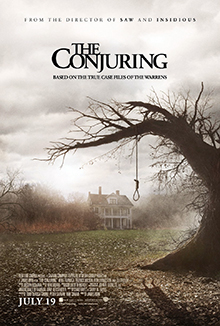

horror

List includes: Devil, The Conjuring

October 2021

0

@volcikas

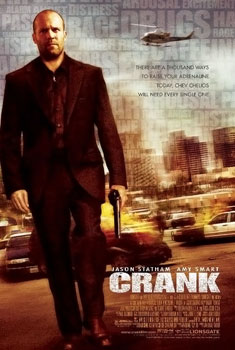

up up up

List includes: Crank, Phone Booth, Prince of Persia: The Sands of Time

October 2021

0

@volcikas

thriller

List includes: Hanna, Nightcrawler, romulus & remus: the first king

October 2021

0

@volcikas

fantasy

List includes: Percy Jackson & the Olympians: The Lightning Thief, Thor, Percy Jackson: Sea of Monsters

October 2021

0

@volcikas