Lists

6 Movies

I cried or almost

Sort by:

Recent Desc

Movies with strong emotional impact.

More lists by Sebastian Bunicz

Discovered thanks to TASTEDIVE

Movies i discovered thanks to this page :)

i recommend those movies!

November 2020

0

@sebastianbunicz

From far away past

Movies i saw as a kid and still remember parts of them

January 2023

0

@sebastianbunicz

Great moments and/or scenes but whole movies not so much

I love only small parts of those movies.

December 2022

0

@sebastianbunicz

Personal best

List of my personal best movies

(nostalgia, preferences, likeness)

December 2022

0

@sebastianbunicz

Not my favourite ones but i could watch them even now :)

My personal AAA (best of the Best are on diffrent list)

December 2020

0

@sebastianbunicz

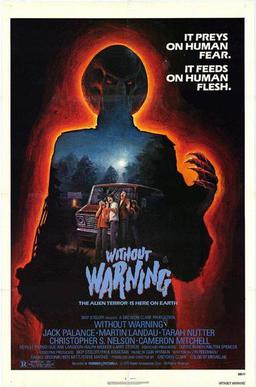

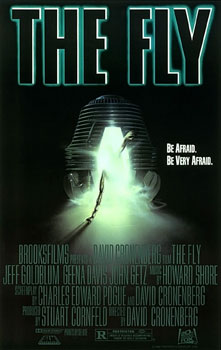

1986 year of Aliens

Let's see what else was in cinema during that great year - my favs

December 2020

0

@sebastianbunicz

Team work. Team spirit

Group of heros or hero within a group.

December 2020

0

@sebastianbunicz

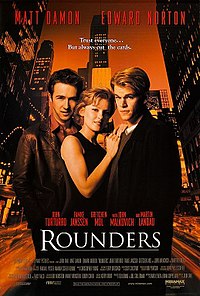

Money, money. Green and greed.

Movies about money - broad spectrum.

December 2020

2

@sebastianbunicz

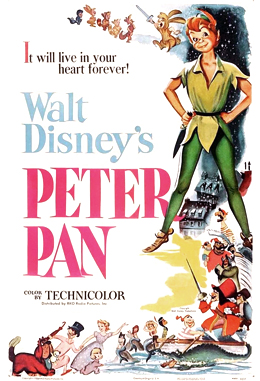

Great animation in my eyes

Wide range from Disney to anime

December 2020

0

@sebastianbunicz