Lists

4 Books

Want to Read

Sort by:

Recent Desc

Liked by

More lists by Diogo Kersting

Will Watch Next

List includes: The Godfather, 30-sai no hoken taiiku, shingeki no kyojin

July 2020

0

@lelouchzenny

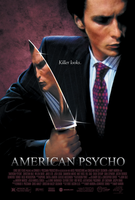

Want to Watch

List includes: American Psycho, The Dark Knight, South Park

July 2020

0

@lelouchzenny

Want to Play

List includes: BioShock, Mirror's Edge, The Legend of Zelda: Twilight Princess

July 2020

0

@lelouchzenny

Will play Next

List includes: Hollow Knight, Disco Elysium

July 2020

0

@lelouchzenny

Masterpiece Anime

List includes: code geass: lelouch of the rebellion, shingeki no kyojin, Attack on Titan

July 2020

0

@lelouchzenny

Ongoing

List includes: Rick and Morty, One Punch Man, Billions

July 2020

0

@lelouchzenny

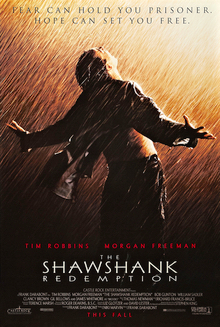

Masterpiece Movies

List includes: Saving Private Ryan, The Shawshank Redemption, The Green Mile

July 2020

0

@lelouchzenny

Masterpiece Games

List includes: The Legend of Zelda: Breath of the Wild, Hollow Knight

July 2020

0

@lelouchzenny

Superhero

List includes: Thor: Ragnarok

July 2020

0

@lelouchzenny