Lists

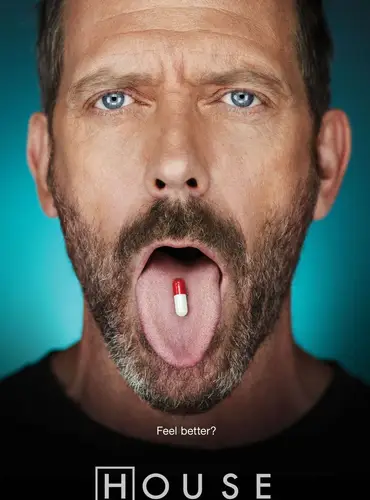

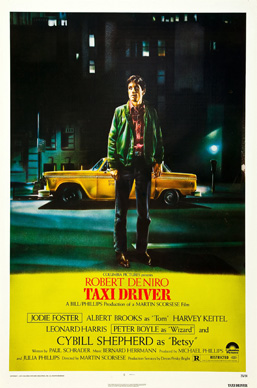

13 Movies, 11 Shows, 8 Books

All Time Best

Sort by:

Recent Desc

Liked by

More lists by Matthew Schaus

Top Books All Time

List includes: The Subtle Knife

August 2021

0

@greenpandaschaus

New Anime to Watch

List includes: Attack on Titan, 91 Days, The Promised Neverland

March 2021

0

@greenpandaschaus

New Movie

List includes: Breaking Bad, Taxi Driver

March 2021

0

@greenpandaschaus

New Tv - Heavy

List includes: House of Cards, Dark

March 2021

0

@greenpandaschaus

New TV - Sitcom

List includes: The IT Crowd

March 2021

0

@greenpandaschaus