Lists

46 Movies, 3 Shows

great films

Sort by:

Recent Desc

better than good films and almost as good at the best

More lists by FairyNight

best animated films

List includes: Mulan, Avatar: The Last Airbender, Mickey Mouse Clubhouse

November 2024

0

@FairyNight

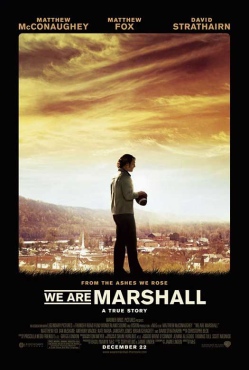

tragic films

List includes: We Are Marshall, Bridge to Terabithia, Desert Flower

October 2024

0

@FairyNight

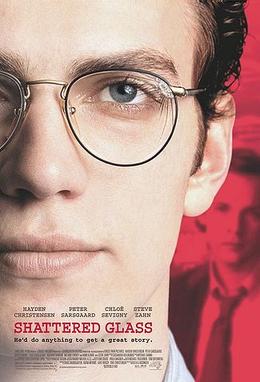

journalism films

List includes: Shattered Glass

October 2024

0

@FairyNight

animals films

List includes: Seabiscuit, Secretariat, Gigi & Nate

October 2024

0

@FairyNight

music films

List includes: The Conductor

October 2024

0

@FairyNight

crime films

no detective movies, no mystery movies, just crime (and eventually the ones marked like that)

April 2024

0

@FairyNight

new update fucked up almost everything in tastedive

ok it got better. they fixed like (like list) and lists so that everything is in good order

February 2023

0

@FairyNight

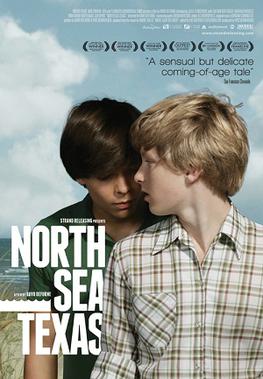

new to watch bl

List includes: North Sea Texas, The Way He Looks, Love, Simon

February 2023

0

@FairyNight

on hold games

List includes: Heavenly Sword, Until Dawn, The Witcher 3: Wild Hunt - Hearts of Stone

February 2023

0

@FairyNight